Residential Solar Energy Credit 2019

Both the residential and commercial ITC are equal to 30 percent of the basis that is invested in eligible solar property which has begun construction through 2019. For residential systems the solar panel system must be placed in service by the end of 2019 to receive the full 30 tax credit according to section 25D of the IRS code governing the renewable energy credit.

Minneapolis Offering The Best Solar Incentives In The Country Early Bird Applications Due Dec 1

Ad Cost Of Residential Solar Search Now.

Residential solar energy credit 2019. Rental property owners who live in the home for three months out of the year for example may only be entitled to 25 of the credit. Over 85 Million Visitors. 50 for any advanced main air circulating fan 150 for any qualified natural gas propane or oil furnace or hot water boiler.

30 for equipment placed in service between 2017 and 2019. Currently the federal credit equals 30 percent of installation costs. Effective January 1 2016 The Iowa Solar Energy System Tax Credit equals 50 percent of the federal tax credits offered for solar energy systems.

Over 85 Million Visitors. You could qualify for a 30 credit on your tax liability. In 2022 the tax credit falls to a permanent 10 percent credit for.

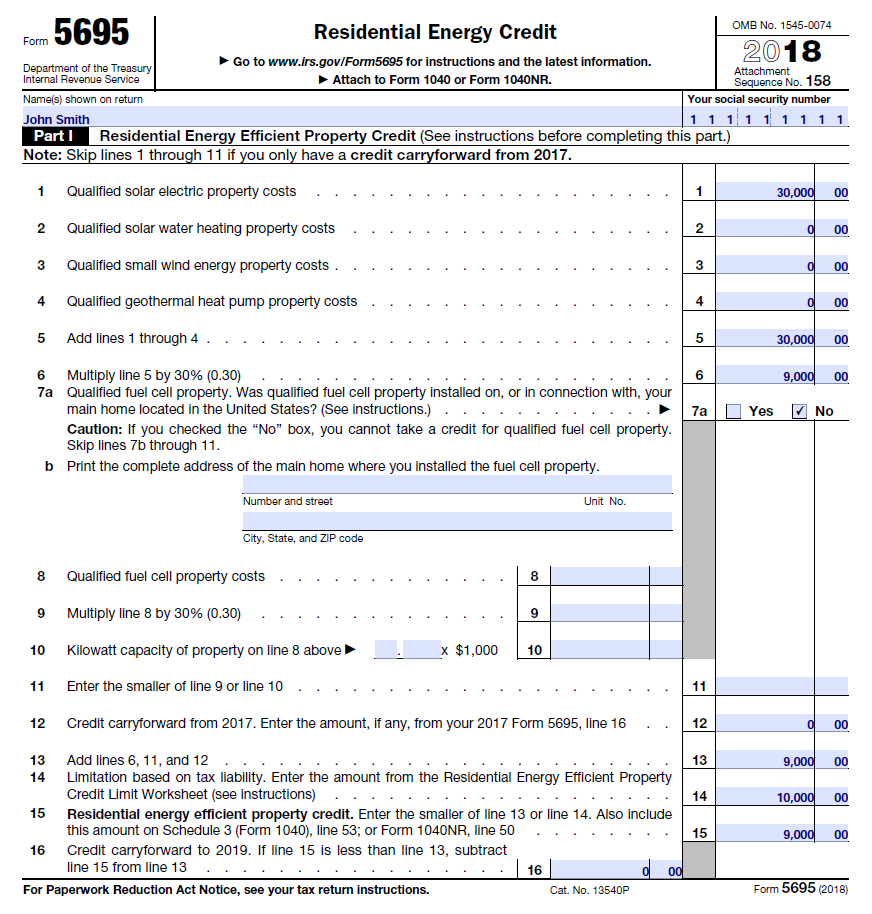

Specifically the taxpayer may take a 30 credit for the costs of the solar panels and related equipment and material installed to generate electricity for use by a residential or commercial building. The residential energy efficient property credit. Solar tax credit amounts.

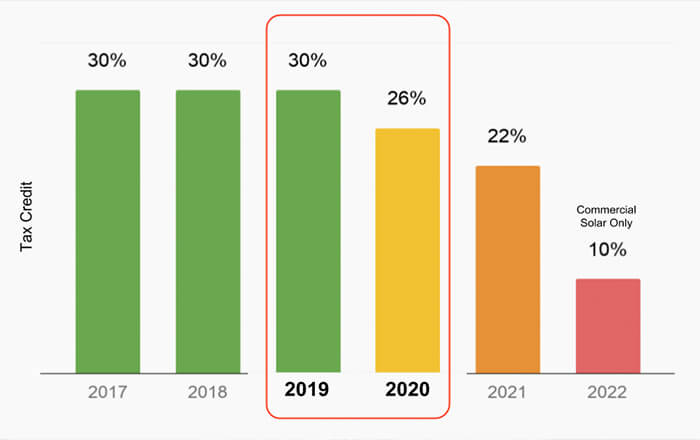

12192019 Current law had the tax credits for solar and geothermal energy falling to 26 percent in 2020 down to 21 percent in 2021. 4272021 In 2018 2019 and 2020 the residential energy property credit is limited to an overall lifetime credit limit of 500 200 lifetime limit for windows. Installing renewable energy equipment in your home can qualify you for a credit of up to 30 of your total cost.

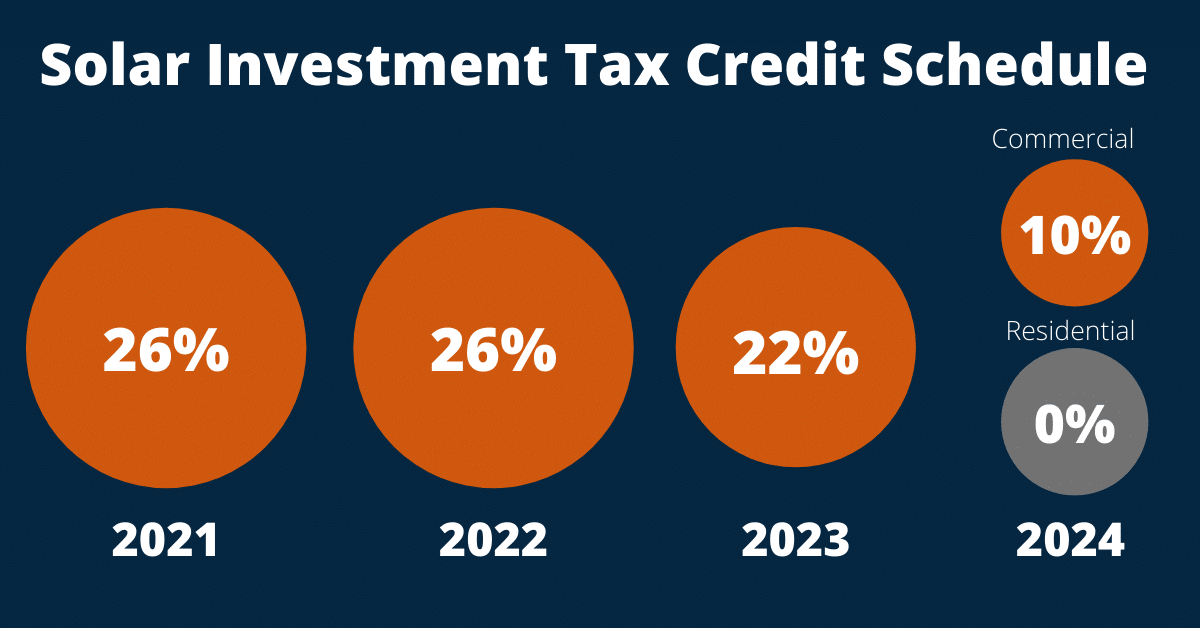

Credit for Solar Energy Devices. The credit is equal to 30 of the cost including installation through 2019 and then it steps down to 26 through 2022. 7152019 The residential energy credit is up to a 30 non-refundable credit on your taxes for your new solar power.

There is no upper limit on the amount of the credit for solar wind and geothermal equipment. An IRS private letter ruling has further clarified that placed in service means the installation is completed. The credit is 22 for 2023 after which it expires.

Ad Cost Of Residential Solar Search Now. All homeowners who install a solar panel system by the end of 2019 can still claim the full. This means you can still get a major discount off the price for your solar panel system.

To encourage investment in solar energy and other alternative energy sources the Internal Revenue Code offers a credit to taxpayers who install solar energy equipment. 3232021 Use Form 5695 to figure and take your residential energy credits. There is no maximum amount that can be claimed.

109-58 created a 30 percent ITC for residential and commercial solar energy. The nonbusiness energy property credit and. The residential energy credits are.

You read that right. There are also other individual credit limitations. The tax credit remains at 30 percent of the cost of the system.

162020 Here are the specifics. However the 30 solar energy tax credit is only available through 2019. Through 2019 qualifying installments will credit homeowners 30 of the total costs.

Federal tax credits are available for property placed in service before January 1 2022. The Energy Policy Act of 2005 PL. If you havent already installed solar be aware 2019 is the last year for 30.

The ITC is based on the amount of investment in solar property. The federal solar tax credit part of the Residential Renewable Energy Tax Credit that offers 30 off your home solar installation is dropping at the end of 2019. Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes.

Solar Energy Technologies And the tax credit expires starting in 2022 unless Congress renews it. 1232021 The current federal solar tax credit guidelines were extended through 2022 when former President Donald Trump signed the Consolidated Appropriations Act 2021 this past December. The ITC then steps down according to the following schedule.

A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayers residence located in Arizona. The percentage you can claim depends on when you installed the equipment. It will decrease to 26 for systems installed in 2020 and to 22 for systems installed in 2021.

A solar PV system must be installed before December 31 2019 to claim a 30 credit.

Solar Incentives In Utah Utah Energy Hub

Solar Incentives In Utah Utah Energy Hub

2019 Is The Last Year For The 30 Federal Solar Tax Credit

2019 Is The Last Year For The 30 Federal Solar Tax Credit

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

The Ultimate 2020 Guide To California Solar Tax Credit And Incentives

The Ultimate 2020 Guide To California Solar Tax Credit And Incentives

Federal Solar Tax Credit Being Reduced After 2019 Solar Technologies

Federal Solar Tax Credit Being Reduced After 2019 Solar Technologies

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

5 Reasons To Go Solar In 2021 My Generation Energy Cape Cod Ma

5 Reasons To Go Solar In 2021 My Generation Energy Cape Cod Ma

Do Solar Panels Increase Home Value Green Mountain Energy

Do Solar Panels Increase Home Value Green Mountain Energy

Energy Storage Tax Credits Explained Energysage

Energy Storage Tax Credits Explained Energysage

When Does The Federal Solar Tax Credit Expire Intermountain Wind Solar

When Does The Federal Solar Tax Credit Expire Intermountain Wind Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

The Federal Solar Investment Tax Credit What It Is How To Claim It

The Federal Solar Investment Tax Credit What It Is How To Claim It

26 Solar Investment Tax Credit Good Energy Solutions

26 Solar Investment Tax Credit Good Energy Solutions

2021 Solar Investment Tax Credit What You Need To Know Alternate Energy Hawaii

2021 Solar Investment Tax Credit What You Need To Know Alternate Energy Hawaii

How Much Does Solar Panel Installation Cost In 2020 Chariot Energy

How Much Does Solar Panel Installation Cost In 2020 Chariot Energy

Solar Panels For Your Home In 2021 10 Things To Know Energysage

Solar Panels For Your Home In 2021 10 Things To Know Energysage

Louisiana Has No More Tax Credits For Solar Owners Business News Nola Com

Louisiana Has No More Tax Credits For Solar Owners Business News Nola Com